Today's Scrap Metal Prices

in Raleigh, NC, Durham, NC

Recycling -12/16/13

-Great Prices

-Outstanding Service

-Industrial Pick Up and Public Drop off

-11 Digital Scales to get you in and out-FAST!

-Junk Cars-We TOW, or you Drive in, or Tow in

Today's prices for Scrap metal:Steel and Copper are steady this week. The good news is we raised copper last week! As many know, prices remain lower then the highs of years ago. See the article below about the equipment company CAT (Caterpillar) that is a major supplier to the mining, metals industry.

Raleigh Scrap Metal Recycling here in NC, has a goal to do our best to pay you the most for scrap metal every day. We also try to communicate the price to make it easy for you. When you call our phone number 919-828-5426 and press 2, you will hear a recording with "Today's prices" where we buy and sell scrap metal at great prices per pound. This is for:

-Steel

-Cast Iron

-Copper

-Yellow Brass

-Red Brass

-Aluminum

-Aluminum Cans

-Appliances

-Computers

-Electronics

-Junk Cars

-Salvage Cars

-Junk Cars

-Salvage Cars

-Stainless Steel

-Batteries

-and more.

We continue to have a three part focus at Raleigh Recycling

1) Public (Drop off)-or we pick up Junk Cars

2) Industrial/Commercial customers

1) Public (Drop off)-or we pick up Junk Cars

2) Industrial/Commercial customers

3) Demolition Customers

If you are a large Commercial, Industrial or Demolition company, you should call our Grant Kiser at 919-710-3805 to discuss prices or call me, Greg at 734-740-9514. We can give you prices for scrap metal, Cardboard, Copper, Electronics, Computers and more.

Or for just Appliances or Junk Metal removal, just call Kenny at 919-348-0545!

An important part of our company is that we have 11 digital, NC State certified scales that we use to service our Industrial and Commercial Customers. Almost double our closest competitor, meaning we get you in and out fast and with accuracy! We are not just a Junk Yard or a Salvage Yard, or even a Scrap Yard. We are a major Raleigh NC, Recycling Center.

Importantly, we sell direct to Steel mills or divisions of steel mills, not to middle men who take a commission, so we pass that savings on to you! We even ship our steel out mostly by rail car (not trucks) to save money in shipping, which we pass on to you

Importantly, we sell direct to Steel mills or divisions of steel mills, not to middle men who take a commission, so we pass that savings on to you! We even ship our steel out mostly by rail car (not trucks) to save money in shipping, which we pass on to you

JUNK CARS, Salvage Cars

1) WE TOW-JUNK CAR-JUNK CAR REMOVAL

-Get Cash on the spot

-Any condition, running or not running

-Keys or no keys, engine or no engine

-Call 919-758-3764 for JUNK CAR REMOVAL!

2) Drive it in, or you tow it in!

-Get Cash on the spot

-Any condition

-In and out fast!

Come to us at:

Raleigh Metal Recycling

2310 Garner Road

Raleigh, NC 27610

Telephone- 919-828-5426

When in Raleigh, Durham, Apex, Butner, Clayton, Garner, Henderson, Oxford, Morrisville, Smithfield, Wake Forest, Burlington, Fayetteville, come see us at:

Raleigh Recycling

2310 Garner Rd.

Raleigh, NC 27610

Tel 919-828-5426

www.raleighscrapmetalrecycling.com

When in Goldsboro, LaGrange, Kinston, Mt. Olive, Smithfield, New Bern, come see us at:

Goldsboro Recycling

801 N. John St.

Goldsboro, NC 27530

Tel: 919-731-5600

When in Goldsboro, LaGrange, Kinston, Mt. Olive, Smithfield, New Bern, come see us at:

Goldsboro Recycling

801 N. John St.

Goldsboro, NC 27530

Tel: 919-731-5600

www.goldsboroscrapmetalrecycling.com

When in Wilson, NC, Tarboro, NC, Rocky Mount, NC, come see us at:

Wilson Scrap Metal Recycling J&G

404 Maury Road S

Wilson, NC, 27892

Tel 252-243 3586

www.wilsonncscrapmetalrecyclingjg.com

When in Wilson, NC, Tarboro, NC, Rocky Mount, NC, come see us at:

Wilson Scrap Metal Recycling J&G

404 Maury Road S

Wilson, NC, 27892

Tel 252-243 3586

www.wilsonncscrapmetalrecyclingjg.com

Greg Brown

gbrown@raleighscrapmetalrecycling.com

Tel 919-828-5426

gbrown@raleighscrapmetalrecycling.com

Tel 919-828-5426

Scrap metal Raleigh, NC, Durham, NC

Appliance Pick up, Appliance Removal, Junk Metal Pick up

Junk Car for Cash-Junk Car Removal-Towing

Appliance Pick up, Appliance Removal, Junk Metal Pick up

Junk Car for Cash-Junk Car Removal-Towing

Caterpillar Has A China Problem

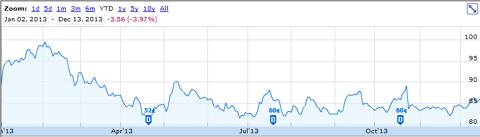

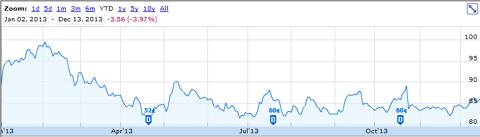

(Click to enlarge)

Now, management has guided to a flat performance in 2014 with sales within 5% of 2013 after a 17% drop from 2012 (full guidance available here). This suggests EPS of about $5.50, plus or minus $0.40 and a forward multiple of 15.6x. As you would expect, mining will be the weakest segment at Caterpillar after falling 40% this year. I had been targeting a 10-15% decline next year, which will erase stabilization and mild improvement at the construction and power units.

With miners, particularly those involved with gold, cutting capital plans next year, it is not surprising to see Cat's mining supply unit the weakest. Freeport-McMoRan (FCX) has promised shareholders a $1.9 billion cap-ex reduction while gold miners like Newcrest and Barrick Gold (ABX) have suspended projects after taking multi-billion write-downs. Barrick is mothballing its Pascua-Lama project, laying off hundreds of workers, after a dilutive secondary. Even diversified giants like Rio Tinto (RIO) and BHP Billiton (BHP) have promised restraint in their capital plans until metal prices start to show sustained improvement.

All of this signals problems for Caterpillar, and the company has been fighting to maintain share and simply suffer along with the market. To lose share in an eroding market would be catastrophic for results. This is my new concern. For years, China had been the savior of machinery equipment firms like CAT and Joy Global (JOY) because the country was consuming so much raw material (boosting prices and thereby cap-ex) without having any companies that could supply machinery of similar quality. As a consequence, CAT got the benefit of the new market without any additional competition. However, this might be changing.

Rio Tinto CEO Sam Walsh has said his firm has begun to buy equipment from Chinese firms and that the quality has been "much higher" than from traditional suppliers (remarks available here). No Chinese firm yet has the scale or brand of Caterpillar, but if some are beginning to churn out equipment of similar or better quality, CAT will have to fight more aggressively for share, especially as many of these firms enjoy significant cost advantages, operating solely in China.

With China a critical end-market and the importance of currying favor with the regime, miners may very well be interested in purchasing equipment from Chinese firms. For Caterpillar, the market is growing increasingly competitive just at the wrong time: when sales are in sharp decline. Lost share or a price war would only exacerbate the company's growth problem. Now, it should not surprise anyone that China is catching up on quality as that is really a matter of time and effort in studying best practices and existing machines.

Moreover, Caterpillar saw this day coming as the company made an $800 million purchase of a Chinese equipment maker, ERA Mining Machinery, last year. Clearly, CAT wanted to gain a production foothold in China and saw a manufacturer whose product quality was worth owning. Of course, this deal has not worked out well for CAT with the revelation that the books were cooked forcing a $580 million write-down (details available here). While CAT clearly targeted the wrong firm, it is equal clear that CAT saw China-made equipment it wanted in its portfolio. It is not surprising then that other Chinese firms are delivering high quality products.

After this news, I am more concerned about Caterpillar than I was before. Given management's track record of over-optimism and tremendous structural weakness in the mining sector, I thought the bottom half of 2014 guidance was more likely, suggesting EPS in the $5.25-$5.50 range. However, if we see price degradation or lost market share, mining declines will be worse, pushing EPS even lower. Equally important, over the long run beyond 2014, CAT's rebound will inevitably be slower as it fends off fierce competition from China. At $86 Caterpillar is appreciably over-priced, and I would be a buyer at no more than 13x earnings or $71. The machinery space is too bad, and investors would be far better owning a high quality miner like Freeport or non-mining machinery company like Deere (DE).

Dec 16 2013, 06:54

Disclosure: I am long FCX.

Needless to say, 2013 has been a challenging year for Caterpillar (CAT). Shares are down 4% while the market has rallied significantly to new heights, and management has called the bottom incorrectly several times with repeated disappointments and guidance cuts. In some ways, Caterpillar has been a victim of circumstances. With falling metal prices and over-levered miners, they have had to cut mining activities and capital expenditures, crushing demand for CAT machinery. Caterpillar's management does deserve blame for not seeing the massive slowdown, guiding to it, and preparing for it, but it cannot be blamed for fluctuations in commodity prices.

(Click to enlarge)

Now, management has guided to a flat performance in 2014 with sales within 5% of 2013 after a 17% drop from 2012 (full guidance available here). This suggests EPS of about $5.50, plus or minus $0.40 and a forward multiple of 15.6x. As you would expect, mining will be the weakest segment at Caterpillar after falling 40% this year. I had been targeting a 10-15% decline next year, which will erase stabilization and mild improvement at the construction and power units.

With miners, particularly those involved with gold, cutting capital plans next year, it is not surprising to see Cat's mining supply unit the weakest. Freeport-McMoRan (FCX) has promised shareholders a $1.9 billion cap-ex reduction while gold miners like Newcrest and Barrick Gold (ABX) have suspended projects after taking multi-billion write-downs. Barrick is mothballing its Pascua-Lama project, laying off hundreds of workers, after a dilutive secondary. Even diversified giants like Rio Tinto (RIO) and BHP Billiton (BHP) have promised restraint in their capital plans until metal prices start to show sustained improvement.

All of this signals problems for Caterpillar, and the company has been fighting to maintain share and simply suffer along with the market. To lose share in an eroding market would be catastrophic for results. This is my new concern. For years, China had been the savior of machinery equipment firms like CAT and Joy Global (JOY) because the country was consuming so much raw material (boosting prices and thereby cap-ex) without having any companies that could supply machinery of similar quality. As a consequence, CAT got the benefit of the new market without any additional competition. However, this might be changing.

Rio Tinto CEO Sam Walsh has said his firm has begun to buy equipment from Chinese firms and that the quality has been "much higher" than from traditional suppliers (remarks available here). No Chinese firm yet has the scale or brand of Caterpillar, but if some are beginning to churn out equipment of similar or better quality, CAT will have to fight more aggressively for share, especially as many of these firms enjoy significant cost advantages, operating solely in China.

With China a critical end-market and the importance of currying favor with the regime, miners may very well be interested in purchasing equipment from Chinese firms. For Caterpillar, the market is growing increasingly competitive just at the wrong time: when sales are in sharp decline. Lost share or a price war would only exacerbate the company's growth problem. Now, it should not surprise anyone that China is catching up on quality as that is really a matter of time and effort in studying best practices and existing machines.

Moreover, Caterpillar saw this day coming as the company made an $800 million purchase of a Chinese equipment maker, ERA Mining Machinery, last year. Clearly, CAT wanted to gain a production foothold in China and saw a manufacturer whose product quality was worth owning. Of course, this deal has not worked out well for CAT with the revelation that the books were cooked forcing a $580 million write-down (details available here). While CAT clearly targeted the wrong firm, it is equal clear that CAT saw China-made equipment it wanted in its portfolio. It is not surprising then that other Chinese firms are delivering high quality products.

After this news, I am more concerned about Caterpillar than I was before. Given management's track record of over-optimism and tremendous structural weakness in the mining sector, I thought the bottom half of 2014 guidance was more likely, suggesting EPS in the $5.25-$5.50 range. However, if we see price degradation or lost market share, mining declines will be worse, pushing EPS even lower. Equally important, over the long run beyond 2014, CAT's rebound will inevitably be slower as it fends off fierce competition from China. At $86 Caterpillar is appreciably over-priced, and I would be a buyer at no more than 13x earnings or $71. The machinery space is too bad, and investors would be far better owning a high quality miner like Freeport or non-mining machinery company like Deere (DE).